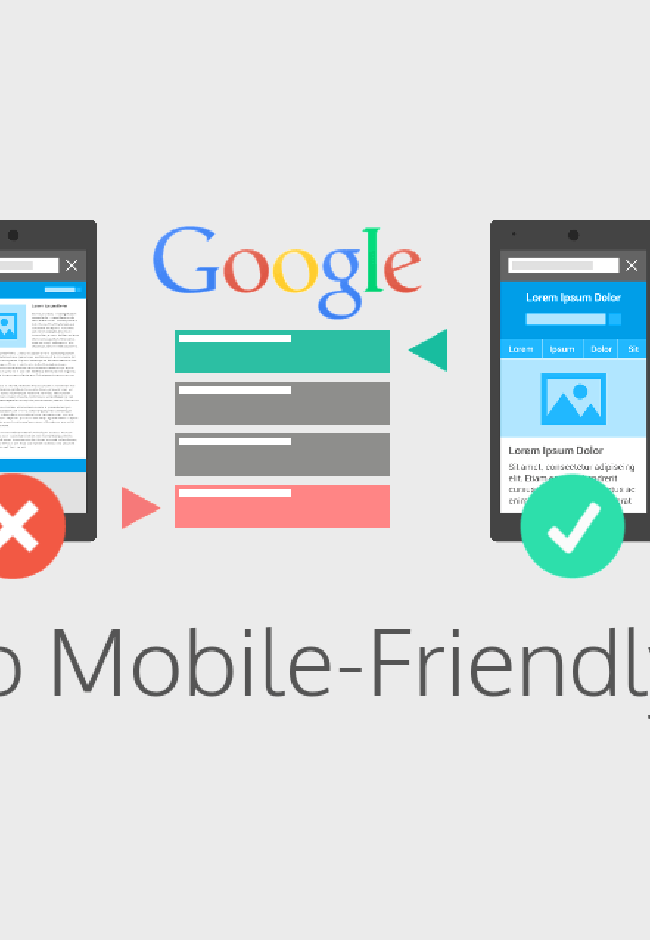

[dropcap]E[/dropcap]l diseño web adaptativo o responsive es una técnica que hoy en día facilita la visualización de una pagina web en los diferentes dispositivos, adaptando los sitios web en los dispositivos sin tener las necesidad de crear dos sitios diferentes.

Por esta razón creemos que el diseño resposive te da la facilidad de crear un diseño que se adecue tanto para los computadores como los smartphones, de esta forma los usuarios obtienen el tamaño de letra adecuado que genera una comodidad de lectura, te garantiza una mayor experiencia de la navegación ya que obtienen botones adaptados para el uso táctil

Understanding Taxes on Betting Winnings in Canada

When it comes to the exhilarating world of betting and gambling, the thrill of winning can sometimes be overshadowed by the looming question of taxes. In Canada, the taxation of betting winnings is a topic that often sparks confusion and uncertainty among both seasoned bettors and newcomers to the scene. Understanding the ins and outs of how taxes apply to your betting successes is crucial to avoid any unexpected financial obligations down the line.

In this article, we delve into the nuances of taxes on betting winnings in Canada, shedding light on the key considerations that every bettor should be aware of. From different types of betting activities to the specific rules and regulations governing taxation, we explore how the Canadian tax system interacts with the world of betting. So, whether you’re a casual bettor looking to brush up on your tax knowledge or a serious gambler aiming to maximize your winnings, join us on this journey to demystify the complex landscape of taxes on betting winnings in Canada.

Overview of Betting Winnings Taxation in Canada

When it comes to betting winnings in Canada, it is crucial for individuals to have a clear understanding of the tax implications. The Canada Revenue Agency (CRA) considers gambling winnings as taxable income, whether it’s from sports betting, casino games, or other forms of gambling. This means that any winnings from these activities must be reported on your annual tax return.

One key aspect that needs to be revealed is that individuals are only required to pay taxes on their net gambling income, which is calculated by deducting gambling losses from winnings. It’s important to keep detailed records of all gambling activities, including wins and losses, to accurately report this information to the CRA. Failure to do so may result in penalties or audits by the tax authorities.

Moreover, it’s essential to note that professional gamblers in Canada are subject to different tax rules compared to casual gamblers. Professional gamblers are considered to be running a business, and as such, they are required to report their gambling winnings and losses on a different section of their tax return. Understanding these nuances can help individuals navigate the taxation of their betting winnings in compliance with Canadian tax laws.

Legal Framework and Regulations for Taxing Betting Winnings

When it comes to betting winnings in Canada, it’s essential to understand the tax implications to ensure compliance with the law. In Canada, gambling winnings are generally not taxed as they are not considered a source of income. This means that if you win money from betting, whether it’s at a casino, online sportsbook, or any other gambling activity, you typically do not have to report it as income on your tax return.

However, there are exceptions to this rule. If you are a professional gambler or if gambling is your primary source of income, you may be required to report your winnings and pay taxes on them. Additionally, if you earn interest on your gambling winnings, that interest is taxable. It’s important to keep detailed records of your betting activities, including wins and losses, to accurately report any taxable income to the Canada Revenue Agency (CRA).

Overall, understanding the tax implications of betting winnings in Canada is crucial to avoid any potential issues with the CRA. While most casual bettors do not have to pay taxes on their winnings, it’s always best to consult with a tax professional or refer to the CRA guidelines to ensure compliance with the tax laws. By staying informed and keeping accurate records, you can enjoy your betting activities without any unexpected tax burdens.

Types of Betting Winnings Subject to Taxation

When it comes to betting winnings in Canada, it’s important for individuals to understand the tax implications. In Canada, betting and gambling winnings are not considered taxable income, so individuals do not have to pay taxes on their winnings. This includes winnings from activities such as sports betting, casino games, and lotteries. However, if an individual is considered a professional gambler, meaning they earn their primary income through gambling activities, they may be subject to taxation on their winnings.

It’s crucial for individuals to keep detailed records of their betting activities, including wins and losses, to accurately report their income to the Canada Revenue Agency (CRA). While most betting winnings are not taxed, individuals are still required to report them on their tax return. Additionally, individuals should be aware that any interest earned on their winnings, such as from bank accounts where the money is deposited, is taxable. By understanding the tax rules surrounding betting winnings in Canada, individuals can ensure they are compliant with the law and avoid any potential issues with the CRA.

Strategies for Minimizing Tax Liability on Betting Winnings

When it comes to betting winnings in Canada, understanding the tax implications is crucial. In general, the Canada Revenue Agency (CRA) considers gambling winnings, including those from sports betting, casinos, and lotteries, as not taxable. This means that individuals who have made money through betting do not have to report these winnings as income on their tax returns. It’s important to note that this exemption applies to recreational bettors and not professional gamblers.

However, if the CRA deems an individual to be a professional gambler, their betting winnings may be subject to taxation. To determine whether someone is considered a professional gambler, the CRA looks at factors such as the frequency of betting, the amount of time spent gambling, and whether the individual relies on gambling as their primary source of income. If someone is deemed a professional gambler, their betting winnings would be considered business income and taxed accordingly.

It is advisable for individuals who have substantial betting winnings or are unsure about their tax obligations to consult with a tax professional. Seeking guidance can help ensure compliance with tax laws and prevent any potential issues with the CRA. By understanding the tax implications of betting winnings in Canada, individuals can make informed decisions and avoid any surprises come tax time.

Understanding the tax implications of betting winnings in Canada is crucial for all individuals engaging in gambling activities. By being aware of the rules and regulations surrounding taxation, Canadians can better manage their winnings and ensure compliance with the law. Whether you are a casual bettor or a seasoned gambler, staying informed about how taxes apply to your winnings can help you make more informed decisions and avoid any potential issues with the Canada Revenue Agency. Remember, knowledge is power when it comes to navigating the world of betting winnings and taxes in Canada.

Aunque todas tienen pros y contras, la web responsive es considerada por muchos expertos como la mejor práctica posible, al unificar la web, reducir tiempos de desarrollo y ofrecer grandes ventajas para el seo movil.

El diseño web adaptativo o responsive es una técnica que hoy en día facilita la visualización de una pagina web en los diferentes dispositivos, adaptando los sitios web en los dispositivos sin tener las necesidad de crear dos sitios diferentes.

Por esta razón creemos que el diseño resposive te da la facilidad de crear un diseño que se adecue tanto para los computadores como los smartphones, de esta forma los usuarios obtienen el tamaño de letra adecuado que genera una comodidad de lectura, te garantiza una mayor experiencia de la navegación ya que obtienen botones adaptados para el uso táctil

Aunque todas tienen pros y contras, la web responsive es considerada por muchos expertos como la mejor práctica posible, al unificar la web, reducir tiempos de desarrollo y ofrecer grandes ventajas para el seo movil.